Looking to boost your investment game??? Dive into our top 5 strategies for successful investing.

In this comprehensive guide, we’ll walk you through tried-and-tested techniques to help you navigate the complexities of the market and maximize your returns.

From diversifying your portfolio to conducting thorough research before making any decisions, we’ve got you covered with practical tips that can help both beginners and seasoned investors alike.

Whether you’re looking to build wealth for the long term or aiming to capitalize on short-term opportunities, these strategies will set you on the path to financial success.

Are You In Hurry? Then Check Out Below!

So, buckle up and get ready to take your investment journey to the next level!

I. Introduction

Unleash Your Wealth Potential Now! Discover the Top 5 Strategies for Successful Investing. Don’t Miss Out! Take Control of Your Financial Future.

A. Importance of Investing Wisely

- Investing wisely is crucial for achieving financial goals and securing one’s future.

- It allows individuals to grow their wealth, beat inflation, and attain financial freedom.

- Making informed investment decisions can lead to long-term financial stability and prosperity.

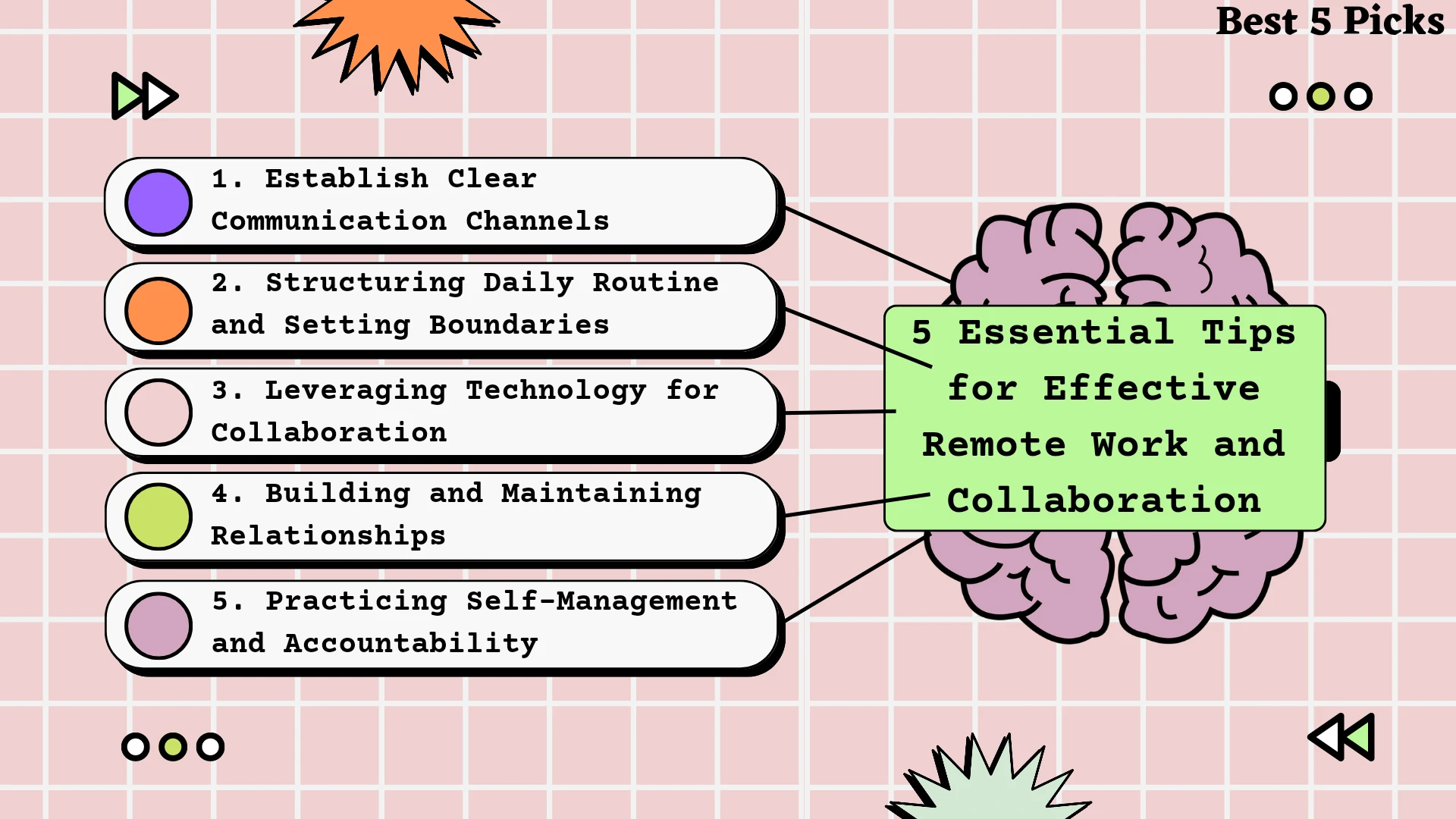

B. Overview of the Top 5 Strategies

- This article explores five essential strategies for successful investing.

- These strategies encompass diversification, research, long-term focus, risk management, and portfolio monitoring.

- Understanding and implementing these strategies can significantly enhance investment outcomes and minimize potential risks.

II. Top 5 Strategies for Successful Investing: Expert Insights and Tips

Discover expert insights and tips for successful investing with our comprehensive article on the top 5 strategies.

Learn the power of diversification, the importance of research and due diligence, and how a long-term approach can enhance your returns.

Explore effective risk management techniques and discover the benefits of regular monitoring and portfolio rebalancing.

Implement these strategies to achieve your financial goals.

Don’t miss out on expert advice and stay ahead in the ever-changing investment landscape. Read now for valuable insights!

1. Diversification: Spreading Risk for Enhanced Returns

A. Explanation of Diversification

Diversification is a fundamental principle in investing that involves spreading your investments across different asset classes, industries, sectors, and geographic regions.

The goal is to reduce the impact of any single investment’s performance on your overall portfolio.

By diversifying, investors aim to minimize the risk of significant losses while maximizing potential returns. Essentially, diversification is about not putting all your eggs in one basket.

B. How Diversification Spreads Risk

Diversification spreads risk by allocating investments across a variety of assets that react differently to market conditions.

For example, when one asset class, such as stocks, experiences a downturn, another asset class, like bonds or real estate, may perform better or remain stable.

This helps cushion the impact of losses in one area of the portfolio with gains in others, thus reducing overall portfolio volatility.

C. Examples of Diversified Portfolios

- A diversified portfolio may include a mix of stocks, bonds, mutual funds, exchange-traded funds (ETFs), real estate investment trusts (REITs), and other assets.

- Within each asset class, further diversification can be achieved by investing in different companies, industries, and regions. For instance, in the stock portion of a portfolio, investments may span various sectors such as technology, healthcare, finance, and consumer goods, both domestically and internationally.

- Additionally, diversification can extend to alternative investments like commodities, precious metals, and cryptocurrencies, providing further risk mitigation.

D. Tips for Effective Diversification

- Assess your risk tolerance and investment goals to determine an appropriate asset allocation strategy.

- Spread investments across different asset classes to reduce correlation and enhance diversification benefits.

- Regularly review and rebalance your portfolio to maintain desired asset allocation percentages.

- Consider investing in low-cost index funds or ETFs to gain exposure to diversified portfolios with minimal effort.

- Avoid over-diversification, which can dilute potential returns and complicate portfolio management.

- Monitor economic and market trends to adjust your diversification strategy as needed, ensuring alignment with changing conditions and objectives.

2. Research and Due Diligence: Making Informed Decisions

A. Significance of Research in Investing

Research plays a pivotal role in investing as it empowers investors to make informed decisions, understand market trends, and identify potential opportunities and risks.

Conducting thorough research enhances investors’ ability to select investments that align with their financial goals and risk tolerance.

Without proper research, investors may be susceptible to making hasty decisions based on emotions or incomplete information, which can lead to suboptimal outcomes and losses.

B. Different Types of Research Tools and Resources

- Financial Websites and News Outlets: Websites like Bloomberg, CNBC, and Yahoo Finance provide up-to-date financial news, market analyses, and investment insights.

- Company Reports and Filings: Annual reports, quarterly earnings releases, and regulatory filings (such as 10-K and 10-Q filings with the SEC) offer valuable information about a company’s financial performance, operations, and management.

- Investment Research Platforms: Subscription-based research platforms like Morningstar, Thomson Reuters, and Zacks Investment Research offer comprehensive analysis, ratings, and recommendations on stocks, mutual funds, and other investment products.

- Technical Analysis Tools: Charting software and technical analysis platforms help investors analyze price trends, patterns, and indicators to forecast future market movements.

- Economic Indicators and Reports: Economic data releases from government agencies (e.g., Bureau of Labor Statistics, Federal Reserve) provide insights into macroeconomic conditions, inflation, employment trends, and consumer sentiment.

C. Conducting Due Diligence Before Investing

Due diligence involves thorough research and analysis of an investment opportunity before committing capital. This process includes:

- Assessing the company’s financial health, management team, competitive position, industry dynamics, and growth prospects.

- Reviewing historical performance metrics, such as revenue growth, earnings per share (EPS), profitability margins, and return on investment (ROI).

- Examining qualitative factors like corporate governance practices, regulatory compliance, and potential legal or reputational risks.

- Comparing the investment opportunity with alternatives to evaluate its risk-adjusted return potential.

D. How to Analyze Investment Opportunities Effectively

- Define investment objectives, time horizon, and risk tolerance.

- Utilize a combination of fundamental analysis, technical analysis, and macroeconomic analysis to evaluate investment opportunities.

- Consider qualitative factors alongside quantitative metrics to gain a holistic understanding of the investment’s prospects.

- Stay updated on market developments and regularly review and adjust your investment thesis based on new information.

- Seek guidance from financial advisors or mentors and leverage their expertise and insights to make informed investment decisions.

3. Long-Term Investing: Patience and Persistence

A. Understanding the Benefits of Long-Term Investing

- Compound Growth: By allowing investments to grow over an extended period, investors can benefit from the compounding effect, where earnings generate additional returns.

- Risk Mitigation: Long-term investors have the opportunity to weather short-term market fluctuations and volatility, reducing the impact of market downturns on their portfolios.

- Time to Recover from Losses: Holding investments for the long term provides the opportunity to recover from temporary setbacks and capitalize on potential market rebounds.

- Tax Efficiency: Long-term investments may qualify for preferential tax treatment, such as lower capital gains tax rates, compared to short-term investments.

B. The Role of Patience and Persistence in Long-Term Success

- Patience allows investors to stay committed to their investment strategies despite short-term market fluctuations or underperformance.

- Persistence involves consistently contributing to investments over time and staying disciplined in adhering to a long-term financial plan.

- Over the long term, patience and persistence enable investors to capture the full potential of compounding returns and achieve their financial goals.

C. Examples of Successful Long-Term Investors

- Warren Buffett: Renowned for his long-term investment approach, Buffett has built wealth by investing in fundamentally strong companies with durable competitive advantages and holding them for decades.

- Peter Lynch: Lynch achieved success as a mutual fund manager by focusing on companies with simple business models, strong growth prospects, and solid management teams, holding positions for the long term.

- John Templeton: Known for his contrarian investment style, Templeton demonstrated the benefits of long-term investing by identifying undervalued stocks and holding them through market cycles to realize substantial gains.

D. Strategies for Maintaining a Long-Term Investment Mindset

- Define clear investment objectives and establish a realistic time horizon aligned with your financial goals.

- Develop a well-diversified portfolio with a mix of assets that can withstand various market conditions over the long term.

- Regularly review and rebalance your portfolio to maintain alignment with your long-term investment strategy and risk tolerance.

- Focus on the fundamentals of investments, such as earnings growth, cash flow generation, and competitive advantages, rather than short-term market fluctuations.

- Cultivate patience and discipline, avoiding the temptation to react impulsively to market noise or short-term trends.

- Seek guidance from experienced investors or financial advisors who can provide perspective and support in maintaining a long-term investment mindset.

4. Risk Management: Balancing Risk and Reward

A. Importance of Balancing Risk and Reward

- Higher returns typically come with higher levels of risk. Investors must find an optimal balance that aligns with their risk tolerance and financial goals.

- Overexposure to risk can lead to significant losses, while being too conservative may result in missed opportunities for growth.

- By striking the right balance between risk and reward, investors can optimize their investment portfolios for long-term success while managing potential downside risks.

B. Different Types of Investment Risks

- Market Risk: The risk of loss due to factors affecting the overall market, such as economic downturns, geopolitical events, or changes in interest rates.

- Credit Risk: The risk of loss stemming from the failure of a borrower to repay a loan or debt obligation.

- Liquidity Risk: The risk of not being able to sell an investment quickly without significantly impacting its price.

- Inflation Risk: The risk that the purchasing power of investments will decrease over time due to inflation eroding the real value of returns.

- Concentration Risk: The risk associated with having a significant portion of investments concentrated in a single asset, sector, or market, leaving the portfolio vulnerable to specific adverse events.

C. Techniques for Managing and Mitigating Risks

- Diversification: Spreading investments across different asset classes, industries, and geographic regions to reduce the impact of any single risk factor on the portfolio.

- Asset Allocation: Allocating assets among various investment categories based on risk tolerance, time horizon, and financial objectives.

- Risk Assessment: Conducting thorough due diligence and risk analysis before making investment decisions to identify and understand potential risks.

- Stop-Loss Orders: Setting predetermined price levels at which to sell investments to limit losses and protect against significant declines in asset values.

- Hedging Strategies: Using derivatives or other financial instruments to offset potential losses in one part of the portfolio with gains in another or to protect against specific risks.

- Regular Monitoring and Rebalancing: Monitoring the performance of investments and periodically adjusting the portfolio to maintain the desired risk-return profile.

D. How to Create a Risk Management Plan

- Assess Risk Tolerance: Determine your willingness and capacity to tolerate risk based on factors such as investment objectives, time horizon, and financial situation.

- Identify Risks: Identify and analyze potential risks associated with different investments, considering both systematic (market-wide) and unsystematic (specific to individual assets) risks.

- Develop Risk Mitigation Strategies: Implement techniques such as diversification, asset allocation, and risk assessment to manage and mitigate identified risks.

- Set Risk Management Guidelines: Establish clear guidelines and parameters for managing risk, including target asset allocation, maximum loss thresholds, and rebalancing frequency.

- Review and Adjust: Regularly review the risk management plan, assess its effectiveness, and make adjustments as needed based on changing market conditions, investment goals, or risk tolerance levels.

5. Regular Monitoring and Portfolio Rebalancing: Staying Ahead

A. The Necessity of Monitoring Investments Regularly

- Markets are dynamic and can experience fluctuations, requiring active management to capitalize on opportunities and mitigate risks.

- Economic conditions, industry trends, and company performance can change over time, impacting the value and performance of investments.

- Regular monitoring allows investors to stay informed about their portfolio’s performance relative to their financial goals and make timely adjustments as needed.

B. How to Identify When Portfolio Rebalancing is Needed

- Significant Changes in Asset Allocation: If the value of certain asset classes within the portfolio deviates significantly from the target allocation, rebalancing may be needed to realign the portfolio with the desired asset allocation.

- Market Volatility: During periods of heightened market volatility or significant price fluctuations, rebalancing can help restore the portfolio’s risk-return profile and reduce exposure to excessive risk.

- Life Changes or Financial Goals: Changes in personal circumstances, financial goals, or risk tolerance may warrant adjustments to the portfolio’s asset allocation or investment strategy.

C. Strategies for Rebalancing a Portfolio Effectively

- Threshold-Based Rebalancing: Set predetermined thresholds or bands for asset allocation deviations (e.g., ±5%) and rebalance the portfolio when asset class weights exceed these thresholds.

- Time-Based Rebalancing: Rebalance the portfolio at regular intervals, such as annually or semi-annually, regardless of market conditions, to maintain the desired asset allocation.

- Opportunistic Rebalancing: Take advantage of market opportunities or valuation disparities to rebalance the portfolio opportunistically, buying undervalued assets or selling overvalued ones.

- Tax-Efficient Rebalancing: Consider tax implications when rebalancing the portfolio to minimize capital gains taxes, such as using tax-advantaged accounts or offsetting gains with losses.

D. Tools and Technologies for Simplifying Portfolio Monitoring

- Portfolio Management Software: Utilize portfolio management tools and software platforms that offer features for tracking investments, analyzing performance, and generating reports.

- Online Investment Platforms: Many brokerage firms and financial institutions provide online portals or mobile apps with portfolio tracking and monitoring capabilities, allowing investors to stay updated on their investments in real-time.

- Robo-Advisors: Automated investment platforms or robo-advisors offer algorithm-driven portfolio management and monitoring services, making it easier for investors to maintain diversified portfolios and implement rebalancing strategies.

- Financial Aggregators: Use financial aggregator apps or services that consolidate all your investment accounts and financial information in one place, providing a holistic view of your portfolio and simplifying monitoring and analysis.

III. Conclusion

In this article, we have explored Top 5 Strategies for Successful Investing: Expert Insights and Tips. Let’s briefly recap these strategies:

A. Importance of Implementing These Strategies in Investment Practice

Implementing these strategies is crucial for achieving long-term financial success and mitigating potential risks.

Diversification helps protect your portfolio from market downturns, while thorough research ensures you make informed decisions.

Long-term investing fosters wealth accumulation, while effective risk management safeguards your investments.

Regular monitoring and portfolio rebalancing ensure your investment strategy remains aligned with your financial goals and evolving market conditions.

B. Encouragement for Readers to Apply These Tips for Successful Investing

As you embark on your investment journey, remember that success requires discipline, patience, and continuous learning.

By incorporating these strategies into your investment practice, you can enhance your chances of achieving your financial aspirations.

Stay committed to your long-term goals, stay informed about market developments, and stay proactive in managing your investments.

With dedication and perseverance, you can navigate the complexities of the financial markets and build a secure financial future for yourself and your loved ones. Happy investing!

IV. Frequently Asked Questions (FAQ)

Why is diversification important in investing?

Diversification is important because it helps spread risk across different assets, reducing the impact of any single investment’s performance on your overall portfolio. By diversifying, you can potentially enhance returns while minimizing potential losses.

How can I effectively diversify my investment portfolio?

To effectively diversify your portfolio, consider investing across different asset classes, industries, sectors, and geographic regions. Aim for a mix of stocks, bonds, real estate, and other assets to spread risk and maximize potential returns.

What role does research play in successful investing?

Research is essential in investing as it empowers investors to make informed decisions, understand market trends, and identify potential opportunities and risks. Conducting thorough research enhances your ability to select investments that align with your financial goals and risk tolerance.

What are the risks associated with investing, and how can I manage them?

There are various risks associated with investing, including market risk, credit risk, liquidity risk, and inflation risk. To manage these risks, consider diversifying your portfolio, conducting due diligence before investing, and implementing risk management strategies such as asset allocation and regular monitoring.

Why is long-term investing beneficial?

Long-term investing offers several benefits, including the potential for compound growth, the ability to weather short-term market fluctuations, and tax advantages for holding investments over extended periods. By adopting a long-term investment mindset, you can maximize the power of compounding and achieve your financial goals.

How can I stay patient and persistent in long-term investing?

Staying patient and persistent in long-term investing involves maintaining a focus on your investment objectives, avoiding knee-jerk reactions to short-term market movements, and regularly reviewing your portfolio’s progress. Trust in your investment strategy and remember that success often comes with time and consistency.

Who are some examples of successful long-term investors?

Warren Buffett, Peter Lynch, and John Templeton are renowned examples of successful long-term investors who have achieved remarkable success by adhering to disciplined investment strategies, staying patient during market downturns, and capitalizing on long-term opportunities.

When should I consider rebalancing my investment portfolio?

You should consider rebalancing your portfolio when the asset allocation deviates significantly from your target allocation, during periods of market volatility, or when your financial goals or risk tolerance change. Regularly monitor your portfolio’s performance and rebalance as needed to maintain alignment with your investment strategy.

What are some effective techniques for portfolio rebalancing?

Effective techniques for portfolio rebalancing include threshold-based rebalancing, time-based rebalancing, opportunistic rebalancing, and tax-efficient rebalancing. Choose a rebalancing strategy that aligns with your investment goals, risk tolerance, and preferences.

Are there any tools or technologies that can simplify portfolio monitoring?

Yes, there are several tools and technologies available to simplify portfolio monitoring, including portfolio management software, online investment platforms, robo-advisors, and financial aggregators. These tools provide features for tracking investments, analyzing performance, and managing portfolios efficiently.

Disclaimer: This article, Best 5 Picks, is a sponsored piece provided by our partner. The recommendations and content shared here have been crafted in collaboration with the sponsor to provide value to our readers.