Embark on a journey into the future of digital finance with our insightful article, “What will be the Top 5 Cryptocurrencies in 2030.” Discover the potential leaders that are poised to dominate the crypto landscape a decade from now.

Uncover the trends, innovations, and market dynamics that could propel these cryptocurrencies to new heights.

Stay ahead of the curve and gain valuable insights into the digital assets that might shape the financial landscape in 2030.

Whether you’re a seasoned investor or a curious enthusiast, this article provides a glimpse into the exciting possibilities that await in the world of cryptocurrencies.

Explore the evolving world of blockchain technology and decentralization as we delve into the characteristics that could make certain cryptocurrencies stand out in the year 2030.

Are You In Hurry? Then Check Out Below!

From established players to emerging stars, our predictions are backed by a thorough analysis of current market trends and technological advancements.

Don’t miss out on understanding the potential future leaders in the crypto space by reading our comprehensive guide to the Top 5 Cryptocurrencies in 2030.

I. Introduction

Cryptocurrencies have gained significant attention and popularity in recent years.

With the rapidly evolving nature of the market, many investors and enthusiasts are curious about which cryptocurrencies could potentially be the Top 5 Cryptocurrencies in 2030.

A. Brief overview of the cryptocurrency market’s evolution from its early days to its current state.

The cryptocurrency market has undergone a remarkable evolution, transforming from its nascent stages to its present-day significance.

This section provides a concise overview of the cryptocurrency market’s journey, tracing its roots back to the inception of Bitcoin and the subsequent development of various altcoins.

From the early days marked by skepticism and uncertainty to the current state characterized by increased recognition, understanding the historical context sets the stage for comprehending the dynamics at play in today’s crypto landscape.

B. Explanation of the growing interest and adoption of cryptocurrencies.

In recent years, there has been a notable surge in interest and adoption of cryptocurrencies worldwide.

This subsection delves into the factors fueling this growing fascination, including the rise of blockchain technology, which underlies most cryptocurrencies.

As global financial institutions, businesses, and individual investors increasingly explore the potential of digital assets, this section aims to elucidate the driving forces behind the mainstream acceptance of cryptocurrencies.

From decentralized finance (DeFi) to non-fungible tokens (NFTs), the diverse applications contributing to this surge in interest are explored, laying the foundation for a deeper exploration of the contemporary cryptocurrency landscape.

II. Factors Shaping the Future of Cryptocurrencies

The future of cryptocurrencies is intricately shaped by ongoing technological advancements, regulatory dynamics, and shifting investor behaviors, creating a landscape where innovation, compliance, and market trends converge to define the trajectory of digital assets.

A. Technological advancements influencing the development of cryptocurrencies.

The landscape of cryptocurrencies is continually molded by technological advancements.

This section examines the cutting-edge innovations and developments influencing the evolution of digital currencies.

From the integration of smart contracts to the exploration of scalability solutions, understanding the technological underpinnings is crucial for forecasting the future trajectory of cryptocurrencies.

As blockchain technology matures, this subsection provides insights into how these advancements may shape the functionality, security, and efficiency of the next generation of cryptocurrencies.

B. Regulatory changes and their impact on the cryptocurrency landscape.

Regulatory frameworks play a pivotal role in determining the legitimacy and widespread acceptance of cryptocurrencies.

This subsection explores the impact of regulatory changes on the cryptocurrency landscape, examining how governments and regulatory bodies worldwide are adapting to the growing influence of digital assets.

From legal frameworks governing Initial Coin Offerings (ICOs) to taxation policies, understanding the regulatory environment is essential for predicting how cryptocurrencies will integrate into the broader financial ecosystem in the coming years.

C. Market trends and shifts in investor behavior towards digital assets.

Market dynamics are influenced by trends and shifts in investor behavior, particularly as more traditional financial players enter the crypto space.

This section analyzes the evolving attitudes of investors towards digital assets, exploring the factors driving increased participation and the changing perception of risk.

Whether it’s the growing popularity of decentralized finance (DeFi) or the impact of institutional investors, understanding market trends is crucial for anticipating the future direction of cryptocurrencies and their role in global finance.

III. Criteria for Assessing Future Leading Cryptocurrencies

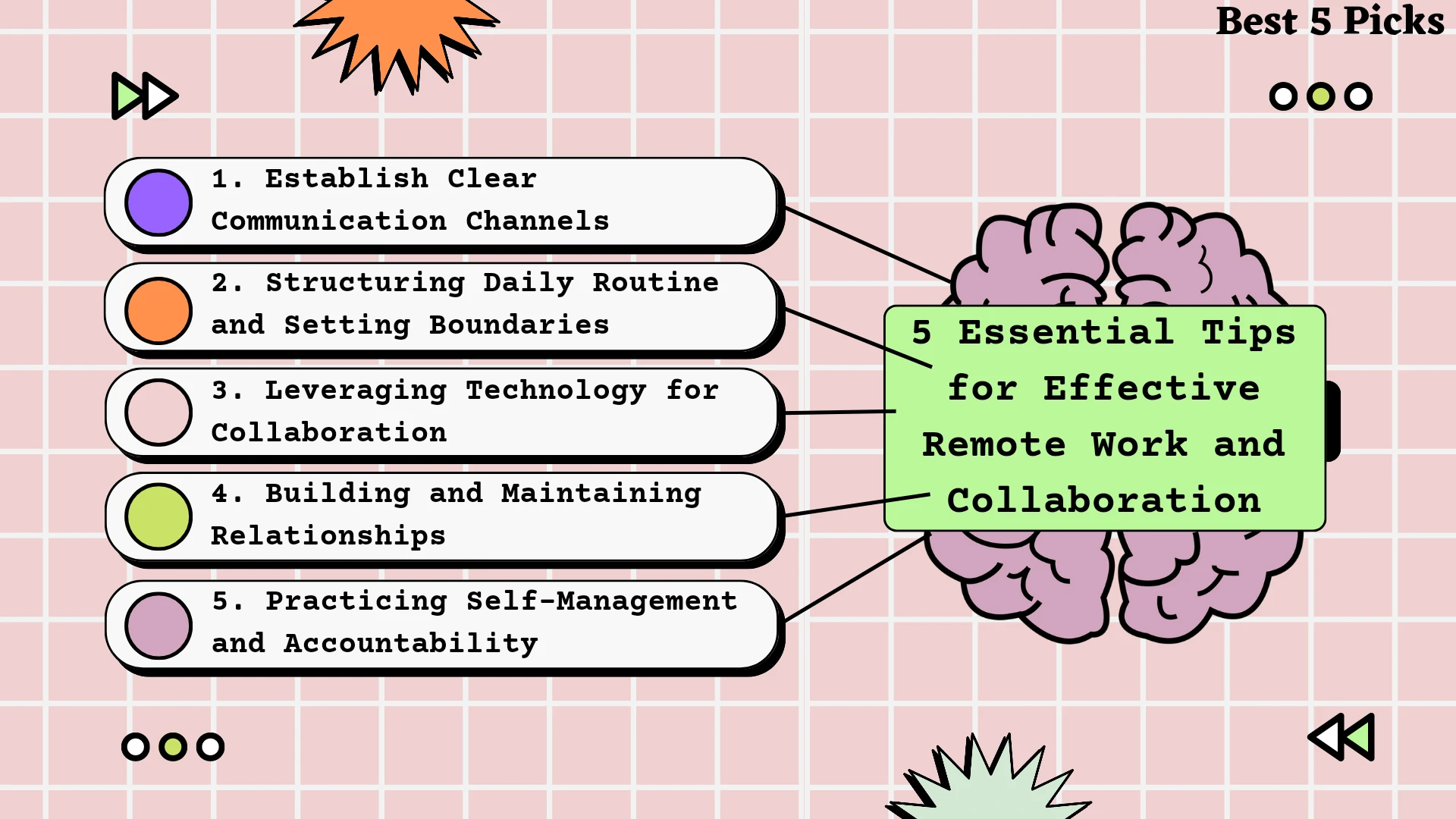

The criteria for assessing future leading cryptocurrencies encompass technological innovation, practical use cases, widespread adoption, a robust community, regulatory compliance, and a focus on long-term viability, all contributing to a cryptocurrency’s potential for success.

A. Discuss the essential factors that contribute to a cryptocurrency’s success (e.g., technology, use case, adoption, community, etc.).

The success of a cryptocurrency depends on a variety of factors. Here are some essential criteria that contribute to a cryptocurrency’s success:

1. Technology:

- Blockchain Architecture: The underlying technology, typically blockchain, plays a crucial role. A secure, scalable, and decentralized blockchain enhances a cryptocurrency’s credibility.

- Consensus Mechanism: The consensus algorithm determines how transactions are verified and added to the blockchain. Proof of Work (PoW) and Proof of Stake (PoS) are common mechanisms.

2. Use Case:

- Practical Application: Cryptocurrencies need a clear and practical use case to solve real-world problems. For example, acting as a medium of exchange, store of value, or facilitating smart contracts.

- Innovation: The ability to introduce novel features or functionalities can set a cryptocurrency apart from others.

3. Adoption:

- Merchant Acceptance: Wide acceptance by merchants for goods and services enhances a cryptocurrency’s utility. This involves creating an ecosystem where users can spend their cryptocurrency.

- Institutional Interest: The involvement of institutional investors and big businesses can add credibility and stability to a cryptocurrency.

4. Community and Ecosystem:

- Developer Community: A vibrant and active developer community is essential for continuous improvement and innovation.

- User Community: A strong and engaged user base can promote adoption and contribute to the network’s decentralization.

5. Security:

- Network Security: Robust security measures, including encryption and protection against 51% attacks, are critical.

- Smart Contract Security: If applicable, ensuring the security of smart contracts is crucial, as vulnerabilities can lead to significant issues.

6. Regulatory Compliance:

- Legal Framework: Adherence to regulatory requirements and a clear legal framework can foster trust among users and investors.

- Compliance with Standards: Following industry standards and best practices helps establish legitimacy.

7. Scalability:

- Transaction Speed and Cost: A successful cryptocurrency should be capable of handling a large number of transactions quickly and at a low cost.

- Scalability Solutions: Implementation of off-chain scaling solutions or other mechanisms to address scalability challenges.

8. Market Perception:

- Public Perception: Public perception and sentiment can significantly impact the value and success of a cryptocurrency.

- Media Coverage: Positive coverage in mainstream media can boost credibility and adoption.

9. Partnerships and Alliances:

- Strategic Partnerships: Collaborations with reputable companies and organizations can enhance a cryptocurrency’s legitimacy.

- Integration with Existing Systems: Integration with existing financial or technological systems can broaden the cryptocurrency’s reach.

10. Long-Term Viability:

- Development Roadmap: A clear and well-defined roadmap demonstrates the long-term vision and commitment of the development team.

- Adaptability: The ability to adapt to evolving technology, market trends, and regulatory changes is crucial for long-term success.

IV. What will be the Top 5 Cryptocurrencies in 2030?

Unlock the Future! Discover the Top 5 Cryptocurrencies in 2030. Don’t miss out on the next big thing. Dive into the crypto revolution now!

1. Bitcoin (BTC)

A. Explanation of Bitcoin’s evolving technology and potential scalability solutions

Bitcoin, introduced in 2009, is the first and most well-known cryptocurrency, designed to operate on a decentralized peer-to-peer network.

Its technology is primarily based on blockchain, a distributed ledger that records all transactions across a network of computers.

1. Blockchain Technology:

Bitcoin’s blockchain serves as a transparent and immutable record of transactions. Blocks containing multiple transactions are linked together using cryptographic hashes, creating a chain.

This decentralized nature ensures security, as altering one block would require changing all subsequent blocks across the network, making the system highly resistant to tampering.

2. Consensus Mechanism:

Bitcoin uses a proof-of-work (PoW) consensus mechanism, where miners compete to solve complex mathematical puzzles to validate transactions and add them to the blockchain.

While effective, PoW consumes significant computational power and energy, leading to concerns about its environmental impact.

3. Scalability Solutions:

Bitcoin has faced challenges related to scalability, particularly in terms of transaction speed and fees.

The limited block size and block time have resulted in slower transaction processing times during periods of high demand.

Several scalability solutions have been proposed and implemented to address these issues:

- Segregated Witness (SegWit): Implemented in 2017, SegWit separates transaction data from the witness data, allowing for more transactions within a block and reducing fees.

- Lightning Network: This is a second-layer scaling solution that enables faster and cheaper transactions by conducting some transactions off-chain. It establishes direct payment channels between users, reducing the load on the main blockchain.

- Taproot: Activated in 2021, Taproot is a soft fork that enhances privacy and efficiency by combining multiple signature scripts into a single Schnorr signature. These solutions aim to enhance Bitcoin’s scalability, making it more efficient and accessible for users.

B. Discussion on its continued dominance as a store of value or digital gold by 2030

Bitcoin’s status as a store of value or “digital gold” is rooted in its scarcity, security, and decentralized nature. Several factors contribute to the ongoing narrative of Bitcoin as a long-term store of value:

1. Limited Supply:

Bitcoin’s maximum supply is capped at 21 million coins, creating scarcity similar to precious metals like gold.

This scarcity is maintained by the halving events that reduce the rate at which new bitcoins are mined approximately every four years.

2. Decentralization and Security:

The decentralized nature of Bitcoin, powered by a vast network of nodes and miners, enhances its resistance to censorship and manipulation.

Its security features, such as cryptographic hashing and the immutability of the blockchain, contribute to its reliability.

3. Global Recognition and Adoption:

Bitcoin has gained widespread recognition and acceptance as a digital asset. Institutional investors, corporations, and individuals have increasingly considered Bitcoin as a hedge against inflation and economic uncertainties.

4. Store of Value Narrative:

The narrative of Bitcoin as “digital gold” has been fueled by its performance during periods of economic uncertainty. Investors often turn to assets like gold or Bitcoin as a store of value during times of inflation or currency devaluation.

While technological advancements and regulatory developments will play a crucial role in Bitcoin’s future, its continued dominance as a store of value depends on its ability to maintain these key attributes and adapt to the evolving financial landscape.

If Bitcoin successfully addresses scalability concerns and continues to gain mainstream acceptance, it could solidify its position as a digital store of value by 2030.

2. Ethereum (ETH)

A. Detailed analysis of Ethereum’s upgrades (e.g., Ethereum 2.0) and its impact on scalability and transaction speed

Ethereum, launched in 2015, is a blockchain platform that supports smart contracts and decentralized applications (DApps).

The network has been actively working on a series of upgrades, with Ethereum 2.0 being the most significant. Here’s an analysis of Ethereum’s upgrades and their impact on scalability and transaction speed:

1. Ethereum 2.0 (Eth2):

- Ethereum 2.0 is a multi-phase upgrade aimed at addressing scalability issues, primarily by transitioning from a proof-of-work (PoW) to a proof-of-stake (PoS) consensus mechanism.

- The upgrade introduces the Beacon Chain, a separate PoS blockchain that runs alongside the existing Ethereum network. Validators on the Beacon Chain propose and validate blocks, improving the overall scalability of the network.

- Eth2 is designed to enhance security, reduce energy consumption, and increase the transaction processing capacity of the Ethereum network.

2. Shard Chains:

- One of the key features of Ethereum 2.0 is the introduction of shard chains. These are smaller chains that operate in parallel to the main Ethereum chain, allowing for increased transaction throughput.

- Each shard chain is capable of processing its transactions and smart contracts, significantly improving the overall scalability of the Ethereum network.

3. Rollups:

- Ethereum is exploring layer-2 scaling solutions like Optimistic Rollups and ZK-Rollups. These solutions aim to increase transaction throughput by processing transactions off-chain while ensuring the security of the main Ethereum blockchain.

- Rollups can significantly reduce transaction fees and increase the speed of transaction processing.

4. EIP-1559:

- Ethereum Improvement Proposal (EIP) 1559, implemented in 2021, aims to improve the user experience by introducing a new fee mechanism. It includes a base fee that is burned during transactions, reducing overall supply and potentially making Ethereum more deflationary.

These upgrades collectively contribute to Ethereum’s journey towards improved scalability and transaction speed.

As Ethereum 2.0 progresses through its planned phases, the network is expected to become more efficient and capable of handling a higher volume of transactions.

B. Insights into its role in decentralized finance (DeFi) and smart contracts by 2030

1. Decentralized Finance (DeFi):

- Ethereum has been a primary platform for the development of decentralized finance applications, offering services such as lending, borrowing, decentralized exchanges, and more.

- The growth of the DeFi ecosystem on Ethereum has been remarkable, with various projects and protocols gaining traction. This trend is likely to continue, with Ethereum serving as a foundational infrastructure for innovative financial applications.

2. Smart Contracts and DApps:

- Ethereum’s primary strength lies in its support for smart contracts, self-executing contracts with the terms of the agreement directly written into code. This functionality enables the creation of decentralized applications (DApps) across various industries.

- As Ethereum evolves, DApps are expected to become more sophisticated and diverse, spanning sectors like gaming, supply chain, identity verification, and beyond.

3. Interoperability:

- Ethereum’s role in the broader blockchain ecosystem will likely involve increased interoperability with other blockchains. Projects working on cross-chain solutions aim to enhance connectivity between different blockchain networks, fostering collaboration and expanding the capabilities of decentralized applications.

4. Scalability Improvements:

- The upgrades discussed in the first part are crucial for Ethereum’s continued role in DeFi and smart contracts. Enhanced scalability will allow the network to handle a higher number of transactions, reducing congestion and transaction fees, making it more attractive for users and developers.

5. Regulatory Landscape:

- The regulatory environment will play a significant role in shaping Ethereum’s future. Clear and favorable regulations may encourage further adoption and development, while regulatory challenges could pose obstacles to growth.

Ethereum is poised to maintain its position as a leading platform for DeFi and smart contracts by 2030.

The ongoing upgrades and improvements in scalability demonstrate the commitment to addressing challenges and ensuring the network’s long-term viability in the rapidly evolving blockchain space.

3. Binance Coin (BNB)

A. Examination of Binance Coin’s ecosystem expansion beyond exchange utility

Binance Coin (BNB) was originally created as an integral part of the Binance cryptocurrency exchange, primarily serving as a utility token for trading fee discounts.

However, BNB has expanded its use cases and ecosystem beyond its initial exchange utility. Here’s an examination of BNB’s broader ecosystem expansion:

1. Launchpad and Token Offerings:

- BNB has been utilized on Binance Launchpad, a platform for launching initial token offerings (IEOs). Users can participate in token sales using BNB, and Binance has hosted numerous successful projects through this platform.

2. Binance Smart Chain (BSC):

- BNB plays a central role in the Binance Smart Chain, a blockchain network developed by Binance to support smart contracts and decentralized applications (dApps). BSC aims to provide a faster and more cost-effective alternative to other smart contract platforms.

3. Transaction Fees and Staking:

- BNB can be used to pay for transaction fees on the Binance exchange, offering users a discount when using BNB instead of other cryptocurrencies. Additionally, BNB holders can stake their tokens on the Binance platform to earn rewards and participate in governance decisions.

4. Merchants and Payments:

- BNB has expanded its utility beyond the Binance ecosystem, with some merchants and online platforms accepting it as a form of payment. This showcases BNB’s potential as a medium of exchange beyond the realm of cryptocurrency trading.

5. Partnerships and Integrations:

- BNB has formed partnerships and integrations with various projects and services, expanding its reach in the broader blockchain and fintech space. These partnerships may include collaborations with decentralized finance (DeFi) platforms, gaming projects, and other blockchain-based applications.

B. Discussion on its potential role in decentralized applications (dApps) and as a native asset in various services by 2030

1. Binance Smart Chain (BSC) and dApps:

- BNB’s integration with Binance Smart Chain positions it as a key asset for developers building decentralized applications. BSC offers a more scalable and cost-effective environment for dApps compared to some other platforms, potentially attracting more developers to build on the Binance ecosystem.

2. DeFi and Decentralized Finance:

- BNB’s role in the decentralized finance (DeFi) space is likely to grow. With the rise of DeFi applications, BNB could serve as a means of collateral, governance, and liquidity provision within various DeFi protocols and platforms.

3. Cross-Chain and Interoperability:

- Binance has shown interest in cross-chain compatibility and interoperability. BNB may play a role in facilitating transactions and interactions across different blockchain networks, contributing to the broader blockchain ecosystem’s interoperability.

4. NFTs and Digital Assets:

- BNB could play a role in the emerging market of non-fungible tokens (NFTs) and digital assets. As NFTs gain popularity, BNB may be used for transactions and activities within NFT marketplaces and platforms.

5. Integration in Traditional Finance:

- BNB’s utility may extend beyond the crypto-native space into traditional finance. Collaboration with traditional financial institutions and the integration of BNB in financial services could further enhance its role as a native asset.

6. Global Adoption and Payments:

- BNB’s acceptance as a payment method may increase, with more merchants and businesses recognizing its value. This could position BNB as a versatile asset for global transactions and payments.

While it’s challenging to predict the future with certainty, the continued expansion of BNB’s use cases and its integration into various services and applications suggest a potential diverse role for BNB in the decentralized and traditional financial landscape by 2030.

The success of BNB’s ecosystem expansion will depend on factors such as regulatory developments, technological advancements, and market adoption.

4. Ripple (XRP)

A. Overview of Ripple’s partnerships and developments in cross-border payments

Ripple (XRP) is a digital payment protocol that aims to facilitate fast and cost-effective cross-border transactions.

Ripple’s technology, including the use of its native cryptocurrency XRP, has been employed to address inefficiencies in the traditional banking system.

Here is an overview of Ripple’s partnerships and developments in cross-border payments:

1. Partnerships with Financial Institutions:

- Ripple has established numerous partnerships with financial institutions worldwide, including banks and payment service providers. These partnerships involve the integration of Ripple’s solutions, such as RippleNet, to enhance the speed and efficiency of cross-border payments.

2. RippleNet:

- RippleNet is Ripple’s decentralized network of financial institutions that use Ripple’s technology to enable cross-border payments. It provides a standardized infrastructure for these institutions to connect and conduct transactions seamlessly.

3. xCurrent, xRapid, and On-Demand Liquidity (ODL):

- Ripple offers various products to financial institutions. xCurrent is a messaging solution that facilitates real-time, traceable payments. xRapid (now known as On-Demand Liquidity or ODL) utilizes XRP as a bridge currency, enabling instant cross-border transactions with reduced liquidity costs.

4. Use of XRP as a Bridge Currency:

- One of Ripple’s key value propositions is the use of XRP as a bridge currency. In this role, XRP serves as a mediator between different fiat currencies, allowing for faster and more cost-effective transfers. This mechanism aims to minimize the need for pre-funded nostro and vostro accounts.

5. Expansion into New Markets:

- Ripple has actively worked to expand its presence in various regions, targeting markets where cross-border payment inefficiencies are particularly pronounced. These efforts include collaborations with financial institutions in Asia, Europe, and the Americas.

B. Assessment of its potential regulatory clarity and adoption as a bridge currency by 2030

1. Regulatory Environment:

- Ripple has faced regulatory challenges, particularly regarding the classification of XRP as a security. In the United States, the U.S. Securities and Exchange Commission (SEC) filed a lawsuit against Ripple Labs in 2020, alleging the unregistered sale of securities. The outcome of this legal battle will significantly impact Ripple’s regulatory clarity and its ability to operate in the U.S.

2. Global Regulatory Developments:

- Regulatory clarity is crucial for Ripple’s global adoption. If Ripple can navigate regulatory challenges successfully and achieve clearer guidelines for the use of XRP, it could enhance trust and confidence among financial institutions and regulators.

3. Adoption as a Bridge Currency:

- The success of XRP as a bridge currency depends on broader adoption by financial institutions and banks. Increased partnerships and integrations with major players in the financial industry could contribute to XRP’s acceptance as a preferred bridge currency for cross-border transactions.

4. Competitive Landscape:

- Ripple faces competition from other blockchain-based solutions and traditional financial networks. The success of XRP as a bridge currency will depend on its ability to provide a competitive advantage in terms of speed, cost-efficiency, and regulatory compliance.

5. Technology Advancements:

- Ripple’s ongoing technological developments, including potential upgrades to its protocol and consensus mechanism, may impact its attractiveness as a bridge currency. Advancements in scalability and security could further position XRP as a reliable option for cross-border payments.

Ripple’s success in the cross-border payments space and its adoption as a bridge currency by 2030 hinge on overcoming regulatory challenges, fostering global partnerships, and maintaining technological competitiveness.

The resolution of regulatory issues and the continued expansion of Ripple’s network will be critical factors in determining its role in the future of cross-border payments.

5. Litecoin (LTC)

A. Exploration of Litecoin’s focus on fast and low-cost transactions

Litecoin (LTC) is a peer-to-peer cryptocurrency created by Charlie Lee in 2011.

It was designed to be a “lite” version of Bitcoin, offering several key improvements, including faster block generation time and a different hashing algorithm.

Here is an exploration of Litecoin’s focus on fast and low-cost transactions:

1. Scrypt Algorithm:

- Litecoin uses the Scrypt hashing algorithm, which is faster and more memory-intensive than Bitcoin’s SHA-256 algorithm. This design choice allows for faster block generation and confirmation times.

2. Faster Block Generation Time:

- Litecoin has a block generation time of 2.5 minutes compared to Bitcoin’s 10 minutes. This faster block time enables quicker transaction confirmations, making Litecoin more suitable for everyday transactions.

3. Higher Coin Supply:

- Litecoin has a higher maximum supply than Bitcoin (84 million LTC compared to 21 million BTC). This larger supply aims to ensure that transactions remain affordable even as adoption and demand increase.

4. Segregated Witness (SegWit):

- Litecoin implemented Segregated Witness (SegWit) in 2017, a protocol upgrade that separates transaction signatures from transaction data. This not only enhances security but also increases the block size limit, allowing more transactions to be included in each block.

5. Low Transaction Fees:

- The combination of a larger supply, faster block generation time, and SegWit implementation contributes to lower transaction fees on the Litecoin network. This makes Litecoin attractive for microtransactions and day-to-day transactions.

B. Discussion on its niche as a payment network and potential integration with emerging technologies by 2030

1. Payment Network Niche:

- Litecoin has positioned itself as “digital silver” to Bitcoin’s “digital gold,” emphasizing its utility for everyday transactions. Its focus on fast and low-cost transactions makes it well-suited for use as a medium of exchange, allowing users to make transactions quickly and at a lower cost than some other cryptocurrencies.

2. Merchant Adoption:

- Litecoin has seen adoption by various merchants as a means of payment. As more businesses and online platforms accept Litecoin, it strengthens its position as a practical choice for everyday transactions.

3. Cross-Border Transactions:

- The fast transaction confirmation times and lower fees make Litecoin a viable option for cross-border transactions. As global commerce continues to evolve, Litecoin’s attributes may find increased relevance in facilitating international payments.

4. Integration with Emerging Technologies:

- By 2030, Litecoin could potentially integrate with emerging technologies to enhance its functionality. Smart contract capabilities, privacy features, or compatibility with layer-2 scaling solutions are examples of areas where Litecoin might evolve to stay competitive and meet the demands of a changing digital landscape.

5. Interoperability and Cross-Chain Solutions:

- Litecoin may explore interoperability with other blockchain networks and cross-chain solutions to facilitate seamless value transfer between different cryptocurrencies and platforms. This could enhance its utility in a multi-chain ecosystem.

6. Integration with Internet of Things (IoT):

- As the Internet of Things (IoT) continues to grow, Litecoin could explore integration with IoT devices for automated and microtransactions. This could involve machines, sensors, and devices using Litecoin for quick and efficient value exchange.

7. Community and Developer Engagement:

- The evolution of Litecoin will also depend on community and developer engagement. Continued support, updates, and improvements to the protocol will be crucial in maintaining and expanding Litecoin’s role as a payment network.

Litecoin’s focus on fast and low-cost transactions positions it as a potential player in the payments space.

Its niche as a practical and efficient medium of exchange, combined with potential integrations with emerging technologies, could contribute to its relevance and adoption in the evolving digital economy by 2030.

V. Challenges and Opportunities

Challenges: Cryptocurrencies face hurdles such as regulatory uncertainties, scalability issues, and security concerns that may impact their widespread adoption.

Opportunities: Clear regulatory frameworks, technological advancements, and integration with emerging technologies present opportunities for cryptocurrencies to grow and become integral to the future of finance by 2030.

A. Identification of potential obstacles and hurdles for top cryptocurrencies to achieve their projected status

1. Regulatory Uncertainty:

- Challenge: Many countries are still working on defining clear regulatory frameworks for cryptocurrencies. Ambiguous or stringent regulations could hinder the growth and adoption of cryptocurrencies, creating uncertainty for investors, businesses, and users.

2. Scalability Issues:

- Challenge: As cryptocurrencies gain popularity, scalability becomes a significant concern. Scaling solutions must be implemented to handle increasing transaction volumes, prevent congestion, and maintain fast confirmation times. Scalability challenges can impact user experience and adoption.

3. Security Concerns:

- Challenge: Security remains a major obstacle, with the risk of hacks, fraud, and vulnerabilities in smart contracts. High-profile security incidents can erode trust and confidence in cryptocurrencies, hindering widespread adoption.

4. Environmental Concerns:

- Challenge: The energy consumption of some proof-of-work (PoW) cryptocurrencies, such as Bitcoin, has raised environmental concerns. Striking a balance between security and sustainability is crucial to address these concerns and mitigate negative perceptions.

5. Interoperability Issues:

- Challenge: The lack of interoperability between different blockchain networks can hinder seamless value transfer and collaboration. Interoperability challenges may limit the potential for widespread integration of cryptocurrencies in various applications and services.

6. Technological Evolution:

- Challenge: Rapid technological advancements may lead to the obsolescence of certain cryptocurrencies that fail to adapt. Cryptocurrencies need to stay at the forefront of technology, addressing issues like privacy, scalability, and smart contract capabilities to remain relevant.

7. Perception and Adoption:

- Challenge: Public perception and understanding of cryptocurrencies can affect their adoption. Overcoming negative associations, such as associations with illicit activities or volatility, is essential for achieving widespread acceptance.

B. Opportunities that could catalyze their growth and widespread adoption by 2030

1. Regulatory Clarity:

- Opportunity: Clear and favorable regulatory frameworks can provide a conducive environment for cryptocurrency growth. Governments and regulatory bodies collaborating with the industry to establish guidelines can boost investor confidence and encourage institutional adoption.

2. Scalability Solutions:

- Opportunity: Continued development and implementation of scalability solutions, such as layer-2 protocols and sharding, can enhance the efficiency of blockchain networks. Scalability improvements ensure that cryptocurrencies can handle a larger user base and transaction volume.

3. Innovation in Technology:

- Opportunity: Ongoing innovation, including advancements in consensus mechanisms, privacy features, and interoperability solutions, can propel cryptocurrencies forward. Projects that successfully address technological challenges and offer improved features may see increased adoption.

4. Mainstream Integration:

- Opportunity: Increased integration of cryptocurrencies into mainstream financial services, businesses, and e-commerce platforms can drive adoption. Partnerships and collaborations between crypto projects and traditional institutions facilitate the acceptance of cryptocurrencies as legitimate assets.

5. Decentralized Finance (DeFi) Growth:

- Opportunity: The expansion of decentralized finance (DeFi) platforms can provide new use cases for cryptocurrencies. DeFi’s growth can create opportunities for lending, borrowing, and earning interest, attracting a broader audience to the cryptocurrency space.

6. Global Economic Trends:

- Opportunity: Economic instability, inflation concerns, and currency devaluation in certain regions can drive individuals and institutions towards cryptocurrencies as a hedge. Cryptocurrencies like Bitcoin are often seen as digital gold and store of value assets during uncertain economic times.

7. Interoperability Solutions:

- Opportunity: Projects that focus on bridging the gap between different blockchain networks and fostering interoperability can unlock new possibilities. Seamless transfer of value and data across various blockchains can enhance the utility of cryptocurrencies in diverse applications.

8. Educational Initiatives:

- Opportunity: Increased education and awareness initiatives can improve public understanding of cryptocurrencies. Educational efforts can help dispel myths, reduce skepticism, and foster a more informed and receptive user base.

9. Integration with Emerging Technologies:

- Opportunity: Integration with emerging technologies such as artificial intelligence (AI), Internet of Things (IoT), and 5G can open up new use cases for cryptocurrencies. Cryptocurrencies may play a role in automated and decentralized systems, enhancing their overall utility.

10. Community Engagement and Governance:

- Opportunity: Active community engagement and decentralized governance models contribute to the resilience and evolution of cryptocurrencies. A strong and supportive community can drive development, improvements, and the adoption of governance mechanisms that align with user interests.

Addressing challenges and leveraging opportunities will play a pivotal role in determining the success and widespread adoption of cryptocurrencies by 2030.

Regulatory clarity, technological innovation, and strategic partnerships are key factors that can shape the future landscape of the cryptocurrency ecosystem.

“Important Disclaimer: This article is a product of research and predictions on potential cryptocurrency trends by 2030.

Any financial decisions made based on this content are at your own risk. We do not assume responsibility for gains or losses resulting from investment decisions.

Please conduct thorough personal research or consult with financial experts before investing.“

VI. Conclusion

In summary, The top 5 cryptocurrencies — Bitcoin (BTC), Ethereum (ETH), Binance Coin (BNB), Ripple (XRP), and Litecoin (LTC) — exhibit diverse strengths and trajectories as they approach 2030.

Bitcoin continues to assert its dominance as a store of value, leveraging its scarcity and decentralized nature.

Ethereum, with ongoing upgrades and DeFi prominence, is poised to play a vital role in the decentralized future.

Binance Coin’s expansion beyond exchange utility and Ripple’s focus on cross-border payments face challenges but hold potential with regulatory clarity.

Litecoin’s emphasis on fast transactions positions it as a niche payment network.

The dynamic nature of the cryptocurrency market is evident in the challenges of regulatory uncertainties, scalability, and security, along with opportunities arising from technological innovations and mainstream integration.

As the market evolves, the trajectory of each cryptocurrency will depend on navigating obstacles and seizing opportunities, reinforcing the dynamic and transformative nature of this rapidly changing landscape.

Investors, developers, and regulators will play crucial roles in shaping the destiny of these digital assets.

VII. Frequently Asked Questions (FAQ)

Why focus on the year 2030 for cryptocurrencies?

2030 is a benchmark year widely discussed for projecting the evolution of various technologies, including cryptocurrencies. This article aims to provide insights into the potential future landscape of the crypto market.

Are these predictions guaranteed to be accurate?

No. Predicting the future of cryptocurrencies, or any market, involves speculation based on current trends, technological advancements, and various factors. The article outlines potential trajectories, but unforeseen events or developments can significantly impact outcomes.

What criteria were used to select the top 5 cryptocurrencies?

The selection criteria encompassed several factors, including technological advancements, use cases, community support, adoption rates, market trends, and regulatory landscapes. Each cryptocurrency’s potential impact by 2030 was also considered.

Why are Bitcoin and Ethereum included among the top 5?

Bitcoin and Ethereum are among the pioneering cryptocurrencies with significant market dominance, technological advancements, and widespread adoption. Their continued relevance and potential future developments contribute to their inclusion.

What distinguishes Litecoin, Ripple, and Binance Coin in this list?

Litecoin focuses on fast and inexpensive transactions, while Ripple aims to revolutionize cross-border payments. Binance Coin extends its utility beyond an exchange token. Each has unique features and potential applications by 2030.

Are there risks or challenges associated with these predictions?

Absolutely. Regulatory changes, technological hurdles, market volatility, competition, and unforeseen events can impact the trajectories of these cryptocurrencies. The article discusses potential challenges and opportunities.

Can I use this article to make investment decisions?

The article aims to provide insights into potential trends. However, it’s crucial to conduct thorough research and consider multiple sources before making investment decisions. Consult with financial experts or advisors for personalized guidance.

Where can I find the full article?

You can access the full article [here]. Dive deeper into the analysis of the top 5 cryptocurrencies and their projected trajectories by 2030.

Is there any way to stay updated on future cryptocurrency trends?

Yes, subscribing to reputable cryptocurrency news sources, staying updated on industry developments, and following reliable analysts can help you stay informed about evolving trends in the crypto space.

How can I contribute or share my views on this topic?

We encourage readers to engage by sharing their opinions, insights, or questions in the comments section of the article or through social media channels to foster discussion and exchange of ideas.

Disclaimer: This article, Best 5 Picks, is a sponsored piece provided by our partner. The recommendations and content shared here have been crafted in collaboration with the sponsor to provide value to our readers.